The German Trade Media Index by OPL Partners

The German Trade Media Index is based on the annual survey of managing partners, managing directors and board members of German B2B and B2G trade media companies by OPL Partners. It provides information about the current economic situation and the expectations of the trade media industry. No concrete business figures are collected, but only percentage developments of selected key figures as well as the managers’ assessments of the economic situation of their companies and the entire industry. The survey is conducted online and anonymously; it is not possible to draw conclusions about individual companies or persons.

The German Specialist Media Index 2022/23 is now available. Here is an overview of the key findings:

German Trade Media Index 2022/23: Is after the crisis before the crisis?

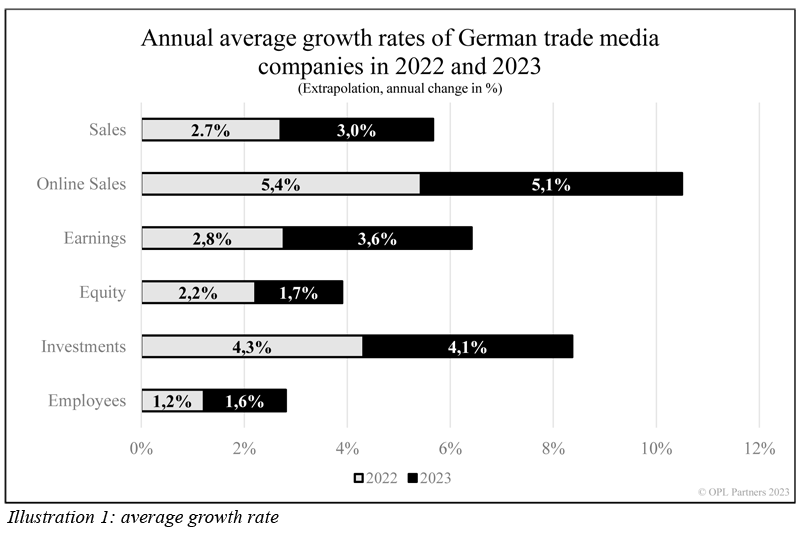

“Robust figures, lousy mood” is how the situation in the German trade media industry can be summarized at the turn of the year 2022/23. Key economic indicators – sales, online sales, earnings, investments, equity, employees – show moderate growth rates on average for the companies surveyed in 2022, with similar growth rates expected for 2023. This is the result of a survey conducted by the consulting company OPL Partners among 135 managing directors, board members and managing partners of German trade media companies, which together account for more than 3.5 billion EURO in sales. Compared to 2022, however, more and more top managers expect the economic situation in the industry and the German economy as a whole to decline in the current year. For their own company, just under half expect the economic situation to improve in 2023, but here, too, the number of pessimists is increasing compared to 2022. The German Trade Media Index is calculated from these as-sessments. In 2022, it increased by 10.8 index points compared to 2021, which means that the overall situation of the German trade media improved in 2022 compared to the previous year. For 2023, this index value drops by 12.2 index points to 98.7. After a slight improve-ment in the sentiment in the German trade media industry in 2022, this indicates a deterio-ration in the mood below the level of 2021.

The clear losers in the sector are numerous (but not all) pure providers of specialized infor-mation, as well as providers of specialized information and trade magazines, who report de-clining or stagnating sales, results, investments and employee numbers, and who at the same time are disproportionately pessimistic about the future for their company, the sector and the German economy as a whole. The clear winners are all the providers of training only and of software only most of their key economic figures for both years are clearly above the industry average and the companies are the most confident about the future. In the case of training companies, the high growth rates can partly be explained by a recovery after the pandemic years, but a clear trend for software is evident, while on the other hand many pure content providers are suffering. This is a sure sign of further disruption and shifts in the industry.

The top managers surveyed see the greatest opportunity for the trade media industry in dig-itization, a finding that is not particularly surprising. After staff shortages, however, the re-spondents also named digitization as the second most frequent risk for the industry, espe-cially for those companies that either have no or very few online sales or have a very high online share. Specialized information providers who missed the online train or jumped on it too late now have to watch their tried and tested business models being cannibalized online. Providers with high online shares are seeing the rest of the market catch up. Although not uncontroversial, AI is also seen often as part of digitization and reflects the fear that AI will not only disrupt the long-established processes of content creation but will also disrupt the underlying business models. This, too, is expected to lead to considerable disruptions and German Trade Media Index 2022/2023 shifts in the industry and will certainly rekindle discussions about the old question of whether content is really still king.

We will be happy to provide you with the complete German Trade Media Index free of charge as a download in German and/or English.

And if you are a managing partner, CEO or board member of a German trade media company, we cordially invite you to participate in the next survey for the German Trade Media Index 2023/24. Please fill out the following form and we will send you a link and password to download the German Trade Media Index 2022/23 and/or include you in the distribution list for invitations to participate in the survey for the next Trade Media Index 2023/24. The next anonymous online survey will take place in November/December 2023, by which time the business figures for the current year should be largely established and the budgets for 2024 made.

Requesting the German Trade Media Index 2022/23 / participation in the survey 2023/24

*required field

If you have any questions, please contact:

Dipl.-Wi.-Ing. Benedict Opl

OPL Partners GbR

Mobile: +49 (1 78) 6 52 77 70

E-Mail: B.Opl@opl.partners